In order to meet the needs of our customers, on the basis of the Release 002 version of the fourth generation futures trading system, we have developed the Release 003 version of the fourth generation futures trading system with rich functions and super core.

01

Xele-Trade Market Maker Mode launched

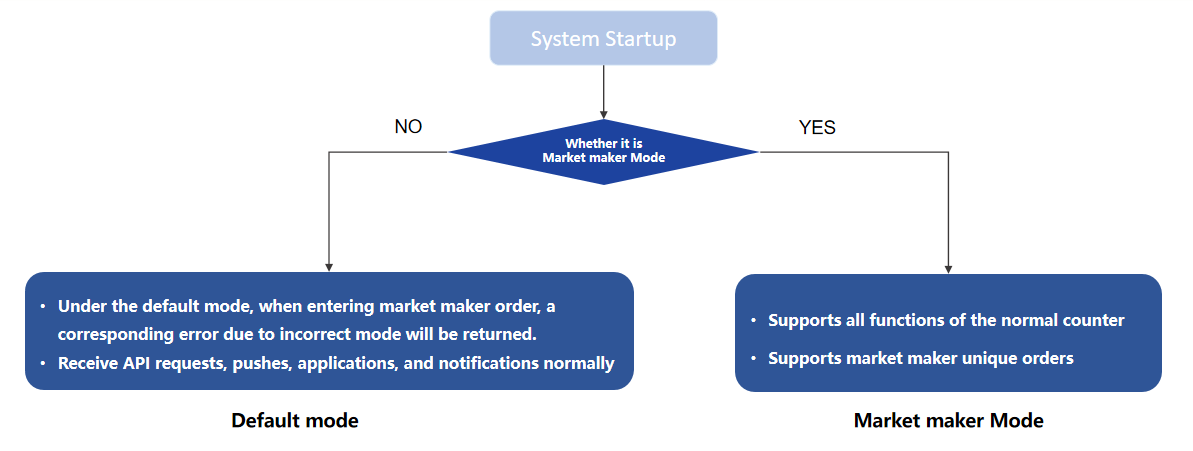

1.One-Click Switch for Market Maker Mode

Release 003 version of the fourth generation futures trading system officially supports market maker business, supports bilateral quotation, bilateral quotation cancellation, inquiry and receipt of inquiry notice and other features.

After turning on the market maker mode, clients only need to use the market maker dedicated API to carry out market making activities.

2.One-Click Multi-Condition Order Cancellation for Market Makers

The One-Click Multi-Condition Order Cancellation is a feature specifically designed for the Xele-Trade Market Maker Mode. With this feature, users can cancel orders based on product type, variety, and contract settings within the one-click order cancellation command.

When market fluctuations occur, Market Maker users can use the One-Click Order Cancellation command to quickly cancel open orders that are eligible for cancellation, mitigating risks. This allows them to respond promptly to market conditions and protect their positions effectively.

02

Further Feature Optimization for the 4th Generation Futures Trading System

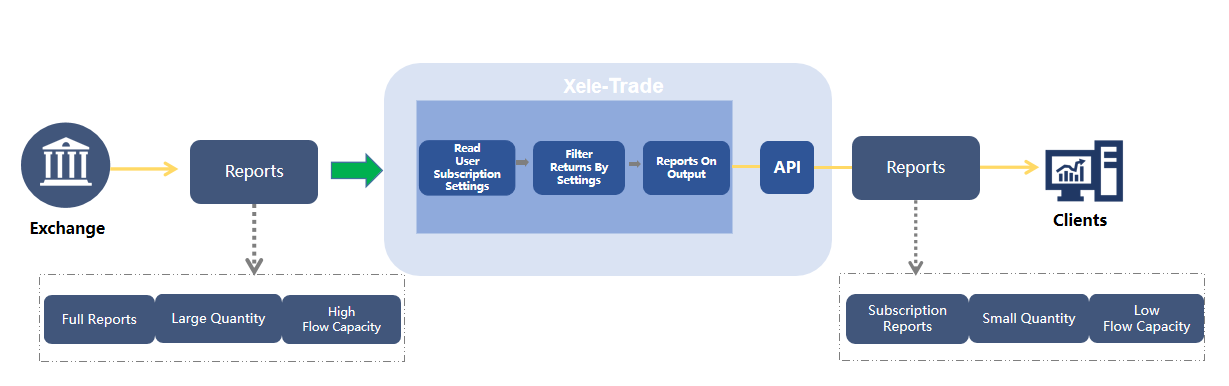

1.Sending Reports Based on Customer-Filtered Conditions

In previous versions, trade order reports were sent to all login addresses associated with the investor, which could lead to data overload, and also failed to meet the demand of receiving only the current strategy’s own trade order reports when multiple strategies were implemented for trading across different varieties.

Release 003 version has addressed this issue by optimizing the report filtering feature. It now supports filtering reports based on product type, variety, and contract, allowing users to specify their preferences. The product types available for filtering include “Options, Futures, Options + Futures.” This optimization helps reduce network traffic and client program processing load by delivering reports only for the specified criteria. Users can customize their report settings to receive relevant data, allowing for a more streamlined and efficient workflow.

2.Support order cancellation by localOrderID

Building upon the previous method of cancelling orders based on system-generated transaction IDs, a new feature has been added to enable order cancellation using user-specific order IDs at the counter level. This optimization allows customers to directly initiate order cancellation requests using their own order IDs, even before receiving an order response.

3.Added combined multi-server for cold backup

The latest Release 003 introduces a powerful multi-server cold backup recovery feature, which enables one backup server to simultaneously receive real-time backups from up to three primary machines. This feature provides a reliable backup solution, ensuring continuous trading operations in the event of a primary server failure or other issues that render primary server unusable.

In the event that a primary server fails to start or experiences other critical malfunctions, the Release 003 version enables a seamless and rapid switch to the backup server. This allows for a quick restoration of business operations, ensuring uninterrupted trading activities.

One of the key advantages of this feature is its ability to maximize backup power savings while enhancing business reliability.

03

Declaration Fee Risk Control Feature, Ensuring Comprehensive Trading Protection

1.Introducing Pre-Declaration Fee Risk Control – Tiered Declaration Fee Structure

On the configuration management page, clients have the ability to customize charging rate and conditions for declaration fees based on various criteria such as investor classification, trading volume, OTR (order-to-trade ratio), and information quantity. The configured settings will determine the corresponding fee rates and conditions for each client.

The configured declaration fee conditions will be implemented after the next reload of the trading system. As clients submit orders, the system will dynamically calculate and deduct the applicable declaration fees from their available funds. This ensures that clients are charged according to their specific fee structure, taking into account their trading activities and associated risk factors.

By implementing real-time pre-declaration fee risk control, the trading platform effectively monitors and manages client positions and available funds to mitigate the risk of account overdraft. This proactive risk control mechanism helps safeguard clients from excessive trading losses and ensures a more secure trading environment.

The ability to customize declaration fee charging standards and the implementation of pre-declaration fee risk control contribute to enhanced risk management, improved transparency, and reduced exposure to potential trading risks for our clients.

2.Added Post-declaration Fee Risk Control – Setting Maximum Declaration Fee per Investor

To prevent the issue of excessive declaration fees resulting from abnormal order placement by trading clients, Release 003 introduces an additional feature called Individual Investor Declaration Fee Control. This feature builds upon the existing risk control mechanism for single contract information volume.

With this feature, it is now possible to set an upper limit for the declaration fees incurred by an individual investor. When the cumulative declaration fees for that investor reach or exceed the set limit, certain restrictions will be imposed. The investor will either be limited to closing positions only or prohibited from further trading activities.

04

More feature highlights

1.The pre-allocation mode of the exchange supports probabilistic sending and priority sending

Release 003 adds priority sending mode under the mode of supporting exchange advance probability sending. The priority of pre-sending orders to each exchange is determined by the configured weight values. When a high-priority preset is available, the system will continue to deliver to the preset; When the preset is not available, the system uses the next priority preset without affecting the declaration of the customer specified preset.

2.Support configuring the login time of trading seats

In previous versions, trading seats were initiated to log in to the exchange according to the start time of the system. Release 003 adds the function of seat login time setting, and member units can set the time of each trading seat login to the exchange.

We sincerely invite you to experience more hardcore features!

Accelecom will always be committed to the advancement of technology, constantly promote innovation, continue to develop more powerful products to meet your diverse needs!