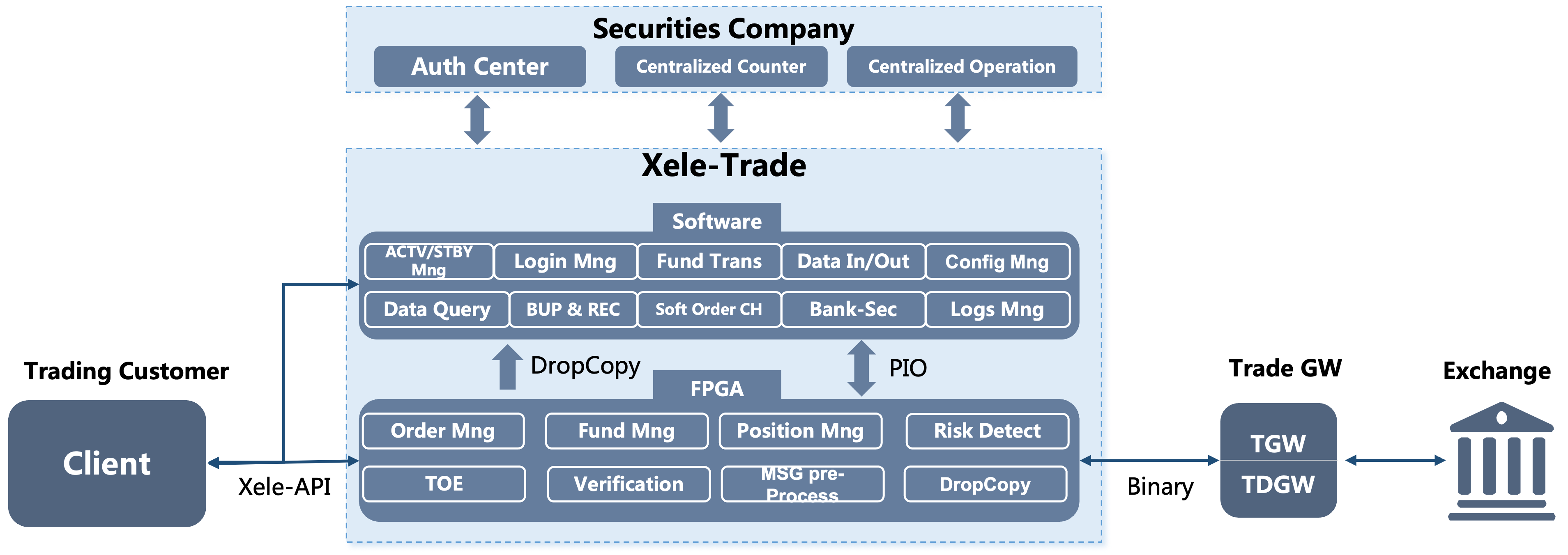

XELE-TRADE is an ultra-fast trading counter system based on FPGA hardware technology, with nanosecond response speed. It provides pre-trade risk control and compliance detection, is a comprehensive solution tailored for VIP clients in securities and futures, as well as fund management institutions and industry giants. As a complete risk control system, XELE-TRADE supports configuration of risk control parameters based on trader characteristics, ensuring comprehensive risk protection.

AcceleCom XELE-TRADE hardware-based ultra-fast trading counter is available in two versions: for securities, and for futures.

XELE-TRADE for Securities

Functional Introduction:

- Supports a wide range of services, including stocks, funds, convertible bonds, options, etc.

- Available in Broker version and QFII version, respectively supporting Xele-API and FIX protocol access.

- Covers major centralized trading counters, including Hundsun, Kingdom (Win & Unix), Kingstar and CROOT.

- Flexible fund allocation between the system and centralized trading transactions, with dynamic allocation capability between Shanghai and Shenzhen trading counters.

- Commission rates and user trading permissions can be synchronized from centralized trading or manually configured locally.

- Supports step-by-step data in/out, allowing manual data reconciliation and support for re-execution.

- The system accommodates single-user multiple-terminal access requests.

- Supports multiple-gateway access, and user orders can be polled between gateways.

- Supports pre-trading parked orders.

- Based on a dual-machine hot standby mechanism and aligned with exchange data, no performance difference after switchovers.

- Well developed features of user login and operation logging.

- Provides a visual operations and maintenance management interface as well as user ordering tools.

Performance Indicators:

- The Xele-Trade system is built on FPGA hardware technology to deliver an ultra-fast trading channel. It supports hundreds of pre-trade risk control checks while still achieving microsecond-level penetration performance.

- The parallel processing capability of FPGA ensures the stability of system penetration latency data during peak periods when processing large volume of concurrency order requests.

- Maintains consistent high-level of penetration performance even when many users are submitting orders concurrently.

- Active/Standby switching RTO is < 10 seconds, RPO = 0.

- The lowest link latency is 1.89ms.

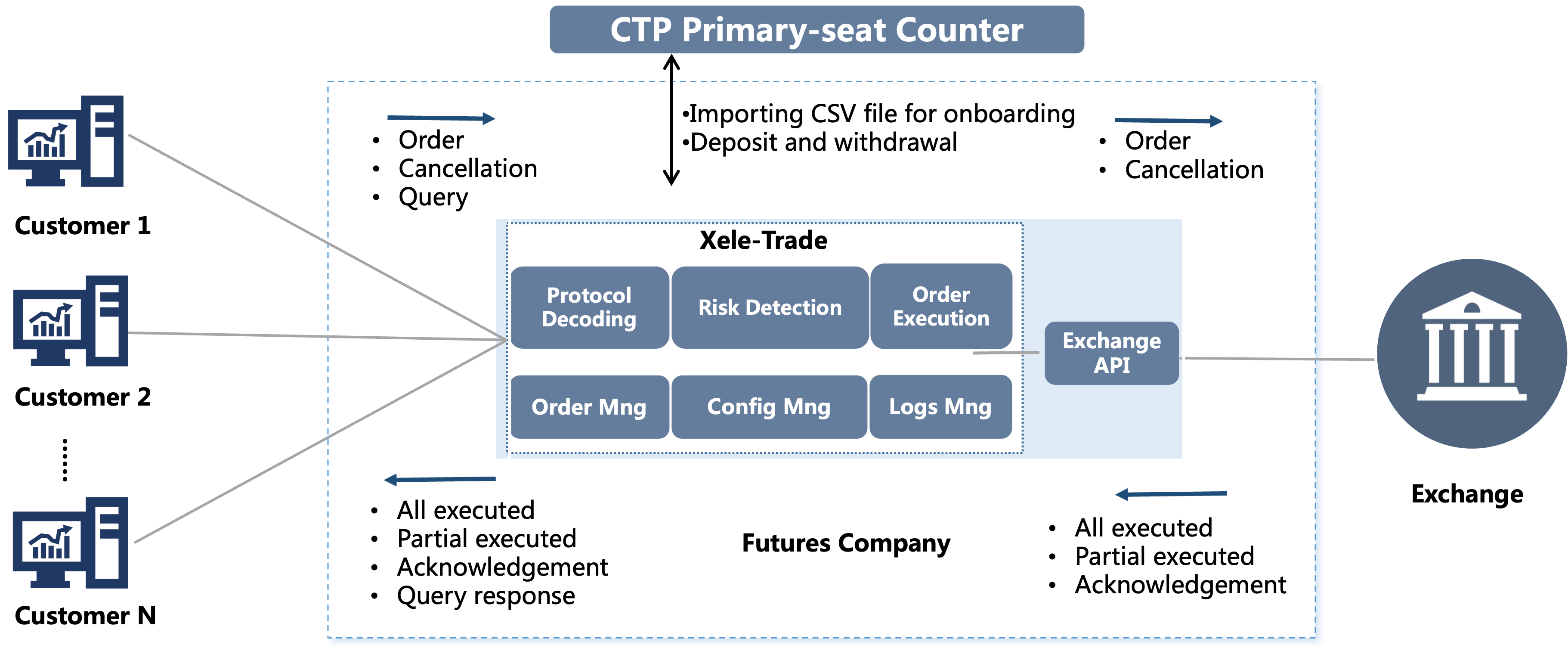

XELE-TRADE for Futures

Functional Introduction:

- Centralized management: B/S architecture management control platform for centralized management of multiple data centers and trading counters.

- System monitoring: Real-time monitoring of hardware resources, software services, and order placement/ cancellation, ensuring service availability.

- Multi-terminal login: Supports login on multiple client terminals which can be divided into trading accounts and query accounts (up to five nodes login).

- Risk control rules: Pre-trade and post-trade risk control, including support for declaration fee risk control rules, ensuring a comprehensive risk control system.

- Front-end optimization: Allow clients to specify front-end orders, or use front-end optimization algorithms built in the trading counters to automatically allocate faster order channels.

- Market Making Counter Mode: Building upon the functionality of the futures trading system, it supports features such as bid-ask quoting, one-click order cancellation, and return filtering.

Performance Indicators:

- Shanghai Futures Exchange (SHFE): Place orders with an interval of 500ns, 8 seats, median latency of 1.5μs.

- China Financial Futures Exchange(CFFEX): Place orders with an interval of 500ns, 8 seats, median latency of 1.6μs.

- Guangzhou Futures Exchange (GFEX): Place orders with an interval of 1μs, 8 seats, median latency of 2.7μs.

- Dalian Commodity Exchange(DCE): Place orders with an interval of 1μs, 6 seats, median latency of 2.2μs.

- UDP order placement/cancellation: Utilizes UDP protocol for efficient order placement and cancellation, minimizing link transmission latency of order requests.

- TCP feedback: Utilizes TCP protocol for reliable receipt of feedback, leveraging its connection-oriented and retransmission mechanisms.